A structure not in an evacuation zone may still be at risk for flooding. Minimizing damage from a flood is a good way to keep your flood insurance costs down.Flood zones and evacuation zones are different. Landscape your yard so it slopes away from your home.Move essential home system equipment above the BFE.If you live in Flood Zone VE, you can better protect your home by: Our policies average $1,202 per year for Flood Zone VE. Your home’s lowest level in relation to your BFE.That’s a wide range, but insurers look at a lot of variables when they price policies, including: How much does flood insurance cost in Zone VE?įlood insurance in Flood Zone VE can cost anywhere between $8,000 and $14,000 per year from the NFIP. Ours can be added to your homeowners insurance with no waiting period, and we match your flood insurance to your homeowners limit so you get more coverage. If you need flood coverage immediately, then an endorsement is probably the best way to go. Excess flood insurance that covers claims that exceed the limits of an NFIP policy.An endorsement to your homeowners insurance to cover floods.If your home floods during that 30 days, your NFIP policy doesn’t cover the damage.īy contrast, private insurers can usually offer higher limits than what you’d get with the NFIP and give you more options, including: The NFIP also has a 30-day waiting period before your coverage takes effect. That average, however, includes homeowners with very little flood risk. The NFIP caps dwelling coverage at $250,000 and personal belongings at $100,000, which may not be enough for your particular situation, and the average policyholder pays $700 per year. While the NFIP is the largest flood insurance program in the nation, it isn’t necessarily the cheapest or the best. private flood insurance for Flood Zone VE Most homeowners who need flood insurance but can’t find someone to insure them can get a policy through the NFIP. This is why the federal government created the National Flood Insurance Program (NFIP). Many companies won’t even offer policies to people in Flood Zone VE because of the increased risk. Electrical, ventilation, plumbing, and air conditioning equipment needs to be above the BFE.Įven if you meet these standards, you may have a hard time getting homeowners insurance.

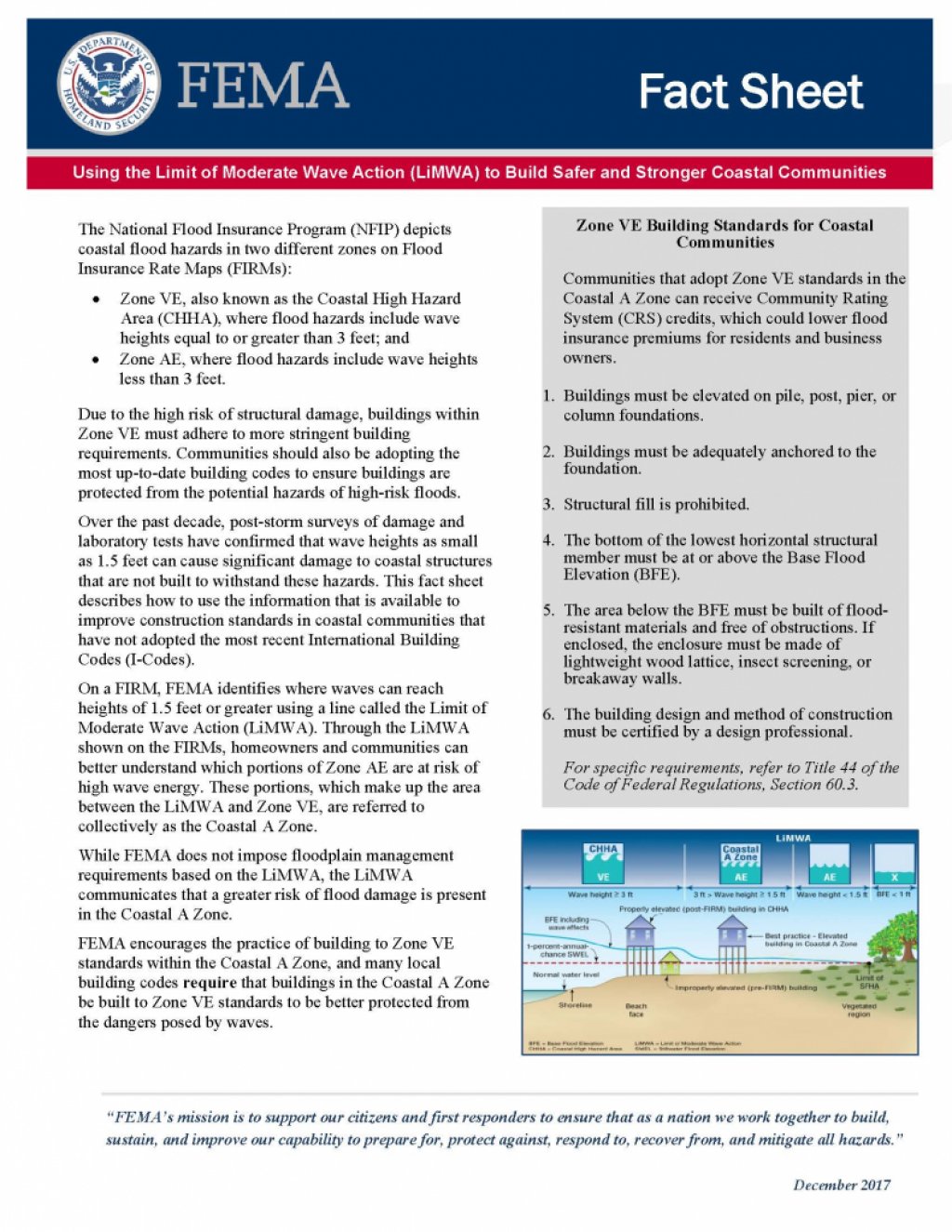

The structure must be elevated by piles, piers, posts, or column foundations.Any unclosed area below the BFE can’t be used as living space.The lowest inhabitable level must be above the BFE.

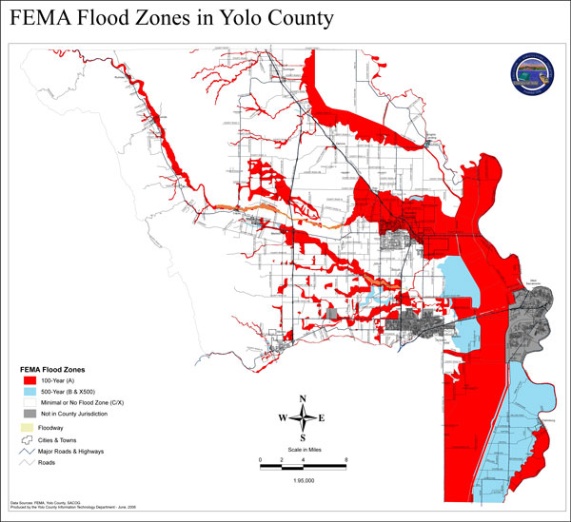

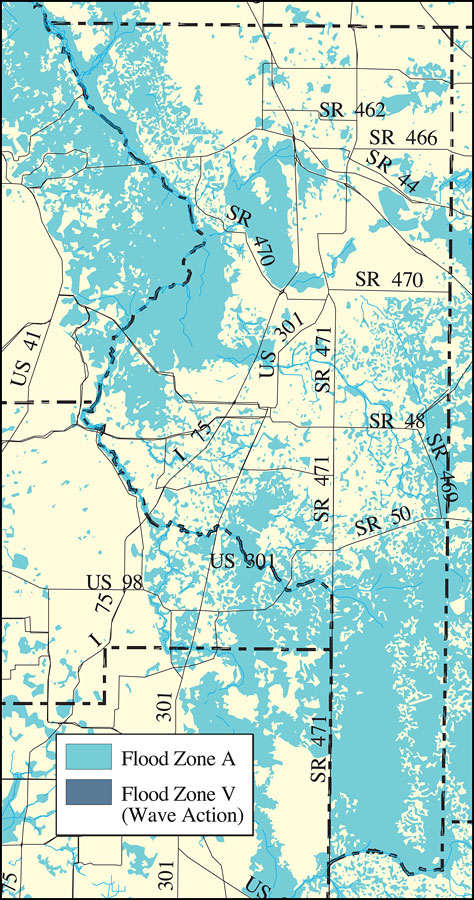

Additionally, your home must meet certain guidelines to qualify for some flood insurance policies: Are homes in Flood Zone VE required to have flood insurance?įlood Zone VE is a Special Flood Hazard Area (SFHA) where homeowners are required to buy flood insurance if they have a federally backed mortgage. Floods may occur more or less often or reach higher or lower levels. While your BFE is a good indicator of an area’s flood risk, it can’t predict what will actually happen. You can go to FEMA’s Flood Service Center to search for your property’s BFE. The BFEs in Flood Zone VE vary by location, but can be as high as 14 feet. What is Flood Zone VE’s base flood elevation?Ī base flood elevation is the height FEMA calculates waters can reach or exceed in a 100-year flood event. The risk increases to 26 percent over the course of a 30-year mortgage. Homeowners in Flood Zone VE have a one percent chance each year of seeing floodwaters rise to the area’s base flood elevation (BFE). The “V” stands for the velocity generated by incoming waves during storms. On top of pooling water and flooding after heavy rains due to nearby streams or rivers, coastal areas have additional exposure thanks to storm surge. It is a Special Flood Hazard Area (SFHA), which means homeowners in this flood zone usually need flood insurance. Flood Zone VE is the Federal Emergency Management Agency (FEMA) designation for high-risk coastal communities.

0 kommentar(er)

0 kommentar(er)